It may be too early to pop the champagne corks, but Manhattan’s big-picture retail leasing scene shows strong signs of putting the pandemic’s carnage behind it.

Even before anyone heard about COVID-19, online shopping reduced demand for brick-and-mortar stores by perhaps 10%. Lockdowns made matters worse.

Readers of this column know that we have been skeptical about polls claiming a major turnaround. Reliable data for retail is more difficult to obtain than for offices. As JLL broker Richard Hodos clearly states, “It’s not an exact science.”

But there appears to be reason to justify landlords’ and brokers’ growing confidence in a healthier market.

JLL and Cushman & Wakefield’s third-quarter Manhattan surveys found significantly lower store availability – 14.7% and 13.9% respectively, compared to peaks in the mid- and high-end of 20% in 2021.

JLL claimed that the amount of available store space in the city “fell to a record low,” which is hard to swallow for anyone who has walked around the Flatiron District, which has been rocked by the closure of several box stores big.

It all depends on how and what you calculate. CBRE said retail lettings were actually up 25% compared to the third quarter in 2023.

But recent transactions give more than enough credence to the idea that the worst is over.

Cushman superbroker Joanne Podell said: “Activity in most trading areas is really strong. What’s interesting is that I think we’re in balance. I don’t think you can define what we’re experiencing as a landlord or tenant market.”

Hodos said, “It’s been a good year overall for most retail corridors. Rents are lower than before the pandemic and occupancy costs are more in line with operating costs.”

He noted that some areas in particular “are vibrant and thriving. In Soho, it’s very difficult to find space on Greene or Prince streets.”

We recently reported on major bids for Bonhams auction house (40,000 square feet in the former Steinway Piano Hall at 111 W. 57th St.); Italian fashion brand Moncler (24,000 sf in a sublease from UnderArmour, which never moved, in the GM building); Five Iron Golf (15,300 sf at Vornado’s 1291 Sixth Ave.); Socceroof (indoor soccer, 20,000 sf at Fosun’s 28 Liberty St.); and Carnegie Diner and an unnamed Greek Cafe in the former NHL store at SL Green’s 1185 Sixth Ave.)

Now, according to other reports, the sources and additions of eye observations include:

• London-based clothing giant Primark will launch its first 54,000-square-foot Manhattan store at 150 W. 34th St. near Penn Station, replacing Old Navy.

• Popular restaurant Rosa Mexicano is taking over the former Ed’s Chowder House space in the Empire Hotel on Broadway at West 63rd Street — 12,000 square feet, mostly on the second floor, that was dark for six years. Fast-growing Italian chain La Pecora Bianca will replace Rosa in its old home on nearby Columbus Avenue.

• Venerable menswear purveyor Brooks Brothers signed on for a 9,500-square-foot store at L&L’s 195 Broadway — a vote of confidence that FiDi office workers and residents still want to wear.

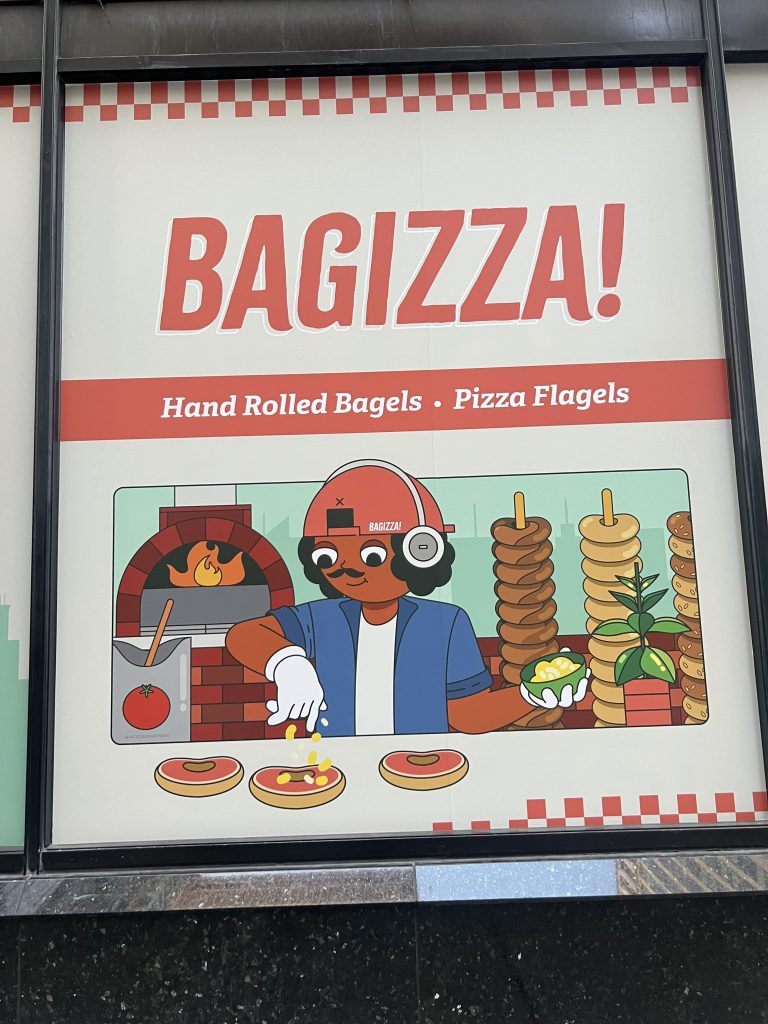

• In perhaps the most surprising move, Joseph Abboud’s elegant former home at 424 Madison Ave. it will soon be home to Bagizza! — a bagel/pizza restaurant concept in more than 4,000 square feet.

CBRE identified two third quarter trends.

“New-to-market vendors leasing their first brick-and-mortar outposts in Manhattan” accounted for 21% of quarterly leasing volume, while “large and experienced fine art tenants” were the main drivers of activity, said CBRE.

Among the new revenue cited by CBRE will be a previously unreported launch of Chinese “fast fashion” brand Urban Revivo’s first US store at 30,000 sf at 513-5155 Broadway. In the latter category: The Arte Museum, an immersive art experience at Chelsea Piers with 51,000 sf, and an unspecified immersive experience by Path Entertainment for 50,000 square feet at 11 Times Square, which developer SJP Properties has long struggled to fill .

Hodos noted that rents have recovered, although not to pre-pandemic levels. “And that’s a good thing,” he said. “The asking rents on Madison Avenue for example were stratospheric and didn’t even come down after the pandemic hit.

“Now, the gap between supply and demand is much smaller.”

#NYC #retail #rent #shows #signs #rebounding #COVID #carnage

Image Source : nypost.com